9 state elections held in 2023

On the special occasion, his father-in-law and actor Suniel Shetty dropped a sweet birthday wish for KL Rahul. Suniel Shetty...

Vidya Balan who plays the lead role in Do Aur Do Pyaar looked ravishing in a navy blue lehenga which...

A 3-wicket haul early in the innings by Mukesh Kumar helped DC bowl out GT for 89 in 17.3 overs.

Soon after the news of Abhradeep Saha’s demise, social media users and fans started paying tribute to the viral sensation....

A video circulating on social media shows the luxury car Lamborghini Gallardo being burned and reduced to ashes. The police...

KKR lost to Royals by two wickets on Tuesday at Eden Gardens.

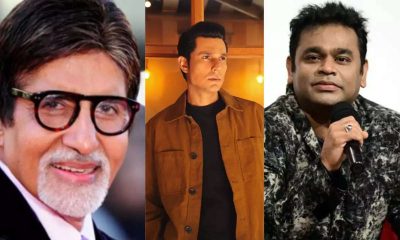

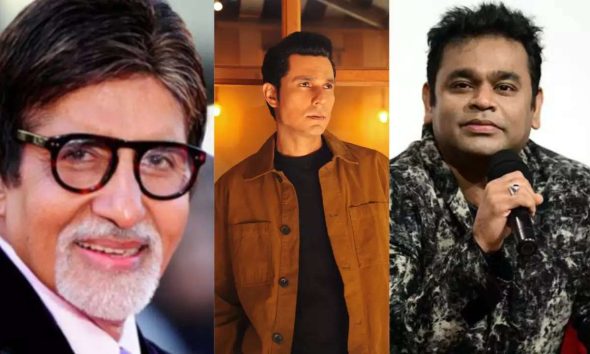

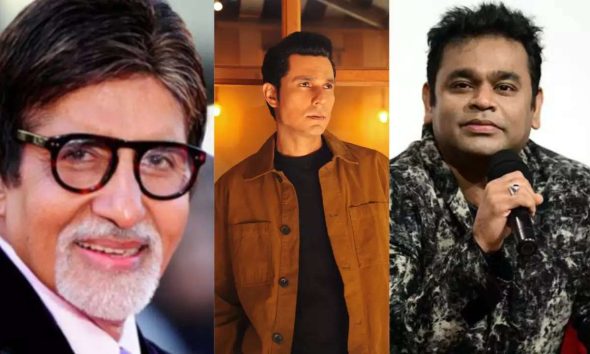

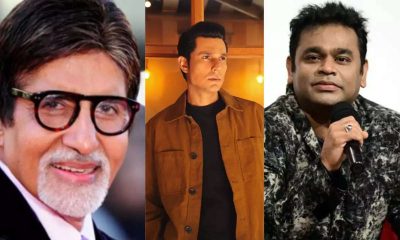

Amitabh Bachchan is set to be awarded the Lata Deenanath Mangeshkar Puraskar, while AR Rahman and Randeep Hooda will also...

Rajasthan Royals were in trouble at one stage of the match but Jos Buttler helped the team recover with an...

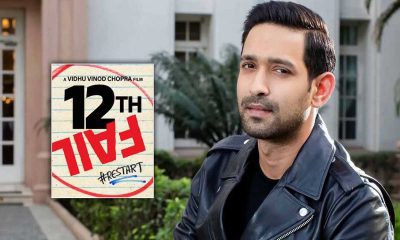

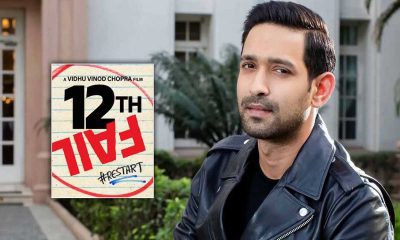

Vidhu Vinod Chopra-helmed 12th Fail is all set to release in China soon

A video shared by a food handle cherishing_the_taste shows the chef coating the gold and silver foils on the puris....

The film, Amar Singh Chamkila, which was released on Netflix recevied a shout out from Amul India

The Bhandari couple was accompanied by 35 individuals in February and led a 4 km procession during which they donated...

Travis Head smashed his century in 39 balls which is the 4th fastest hundred in the competition as he set...

The Enforcement Directorate (ED) made the claim before special judge for ED and CBI cases, Kaveri Baweja, who gave directions...

BJP leader Suvendu Adhikari wrote a letter to the West Bengal Governor and sought a probe by the National Investigation...

The Election Commission advised the Bengal Governor to call off his proposed visit to Cooch Behar on April 19.

The Enforcement Directorate said in a statement that the Mumbai zonal office of ED has provisionally attached immovable and movable...

The Religious group broke glass windows and flower pots and pelted stones on the statue of St. Mother Teresa at...

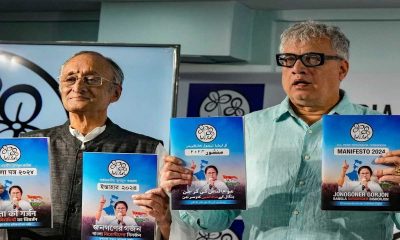

The Trinamool Congress has today released its manifesto for the Lok Sabha elections

Singer and TV personality Rahul Vaidya was recently stranded in the Dubai rains.

The Bengal chief minister added at an election rally that the BJP will win the election by vote looting and...

The UAE witnessed record-breaking rainfall on Tuesday and the National Centre of Meteorology recorded 254 mm of rainfall in less...

Surya Tilak illuminated the forehead of Lord Ram Lalla idol at the Ram temple in Ayodhya on Ram Navami

MK Stalin said if PM Modi comes to power again, the country will be pushed back by 200 years and...

PM Modi also recalled the consecration ceremony of Ram Lalla at the Ram Temple in Ayodhya on January 22.

The BJP on Tuesday released its 12th list of seven candidates for the upcoming Lok Sabha elections

The prime minister made a scathing attack at the opposition and said Ghamandia Gathbandhan has no vision or trust. He...

AAP MP Sanjay Singh read out a message from jailed Delhi chief minister Arvind Kejriwal.

The Mumbai Crime Branch has arrested two accused for their alleged involvement in the firing incident outside Salman Khan's house.

APN News is today the most watched and the most credible and respected news channel in India. APN has been at the forefront of every single news revolution. The channel is being recognized for its in-depth, analytical reportage and hard hitting discussions on burning issues; without any bias or vested interests.

The Prime Minister said that he does not mean to scare or suppress anyone, but rather has plans to make...

The Bollywood actor met Tibetan spiritual leader Dalai Lama in Himachal Pradesh’s Dharamshala and said it as one of the...

The Election Commission of India records highest inducement seizure of Rs 4,650 in 75-years of history.

© Copyright 2022 APNLIVE.com