9 state elections held in 2023

Ishwar Dwivedi captioned the video this is how Air India handles our expensive musical instruments. He asked social media users...

Mahesh Babu took to his Instagram handle and shared a couple of pictures from the photoshoot. In the 1st photo...

AB De Villiers said RCB let Yuzvendra Chahal go. He termed it as a heartbreaking moment. De Villiers said Chahal...

Aamir Khan is gearing for the shooting of his next film, Sitaare Zameen Par

Heeramandi: The Diamond Bazaar is scheduled to be released on 1st May, only on Netflix!

Delhi Capitals were set to bat first, Pant (88 not out of 43 deliveries) and Axar Patel (66 off 43...

A video of Karisma Kapoor and Madhuri Dixit’s dance performance was shared by Colors TV on social media. In the...

The video clip was posted by a restaurant’s Instagram account Nini's Kitchen and was titled Ghar se door, ek waiter....

Ruturaj Gaikwad’s century was overshadowed by Australia’s Marcus Stoinis who smashed a stunning century to help LSG seal a thrilling...

In the short video clip that was recorded by Instagram user Zibran, an electric car is seen parked at a...

In the video Dolly is seen arriving in a car at Burj Khalifa. As he gets down, he is accompanied...

Manisha Koirala, who is making a comeback with 'Heeramandi', spoke about declining a Yash Chopra film.

Atif Aslam’s reaction towards his female fan was praised by a number of individuals who were attending the concert and...

Congress chief Mallikarjun Kharge wrote an open letter to PM Modi and said the Prime Minister is being misinformed by...

The Samajwadi Party has announced Akhilesh Yadav as its official candidate for the Kannauj Lok Sabha seat today

The voting period has been extended by two hours for a total of 299 polling stations

The Bollywood actor posted a video on her Instagram handle which showed her journey through various districts of Bihar, including...

Nilkrishna Gajare’s father is a farmer and had to discontinue his own education after Class 12 as he faced financial...

Arunachal Pradesh Chief Minister Pema Khandu said that instructions have been given for the restoration of connectivity at the earliest

Actor Tamannaah Bhatia has been summoned for allegedly promoting the viewing of the IPL matches on the Fairplay betting app.

The 81-year-old Congress leader was speaking at a election rally in Afzalpur and said that if the people did not...

A disturbing video of the incident - which was unfortunately streamed live on X (formerly Twitter), including by his own...

PM Modi was speaking at a public meeting in Chhattisgarh's Surguja, where he alleged that the Congress wants to fill...

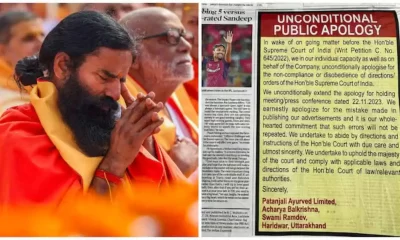

In the apology published, Ramdev and Balkrishna said they unconditionally apologise in their individual capacity as well as on behalf...

Gandhi further added that everyone should look at Prime Minister Narendra Modi’s reaction and said that the moment he said...

PM Modi slammed Congress during a rally in Chhattisgarh, ahead of the Lok Sabha elections 2024

Amit Shah revealed the BJP's target for West Bengal and said they have set a target of winning 35 Lok...

PM Modi was addressing an election rally in Rajasthan's Tonk-Sawai Madhopur, on a day as India celebrates Hanuman Jayanti.

President Draupadi Murmu presented the Padma Bhushan awards to veteran actor Mithun Chakraborty and legendary singer Usha Uthup in New...

APN News is today the most watched and the most credible and respected news channel in India. APN has been at the forefront of every single news revolution. The channel is being recognized for its in-depth, analytical reportage and hard hitting discussions on burning issues; without any bias or vested interests.

Sharad Pawar said that former prime ministers worked to make a new India but PM Modi only criticises others and...

One gun and some cartridges have been recovered from the Tapi river in Surat by the Mumbai Crime Branch in...

Yashasvi Jaiswal looked in top class form as he was the top-scorer of Rajasthan Royals with 104 runs off 60...

© Copyright 2022 APNLIVE.com