9 state elections held in 2023

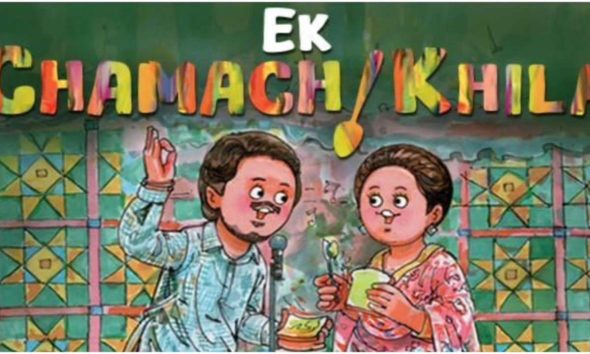

The film, Amar Singh Chamkila, which was released on Netflix recevied a shout out from Amul India

The Bhandari couple was accompanied by 35 individuals in February and led a 4 km procession during which they donated...

Travis Head smashed his century in 39 balls which is the 4th fastest hundred in the competition as he set...

Pulkit Samrat and Kriti Kharbanda today shared their wedding video on social media on the occasion of completing one month...

The Bollywood actor met Tibetan spiritual leader Dalai Lama in Himachal Pradesh’s Dharamshala and said it as one of the...

Salman Khan took to his Instagram handle to share an update about his gym brand, which marks the first post...

Janhvi Kapoor attends Radhika Merchant's bachelorette party. Janhvi Kapoor attended Radhika Merchant's bridal shower over the weekend

A video circulating on social media shows Shah Rukh Khan picking up discarded KKR flags off seats and the floor...

Following the MI vs CSK match, Jasprit Bumrah walked into the CSK dressing room and posed for a photo with...

Pathirana took the wickets of Surya Kumar Yadav (0), Ishan Kishan (23), Tilak Varma (31) and Romario Shepherd (1) to...

The film was released on Nextflix on April 12.

Ranbir Kapoor and Alia Bhatt tied the knot in 2022, on April 14 in the presence of close friend and...

The film was released in the theaters on the occasion of Eid, April 11.,

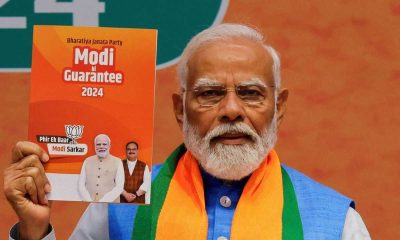

The BJP on Tuesday released its 12th list of seven candidates for the upcoming Lok Sabha elections

The prime minister made a scathing attack at the opposition and said Ghamandia Gathbandhan has no vision or trust. He...

AAP MP Sanjay Singh read out a message from jailed Delhi chief minister Arvind Kejriwal.

The Mumbai Crime Branch has arrested two accused for their alleged involvement in the firing incident outside Salman Khan's house.

The Prime Minister said that he does not mean to scare or suppress anyone, but rather has plans to make...

The Election Commission of India records highest inducement seizure of Rs 4,650 in 75-years of history.

PM Modi was addressing a public rally in Palakkad, where he took a dig at the Congress MP from Wayanad...

The Delhi CM was arrested by the Enforcement Directorate on March 21, hours after the high court refused to grant...

Akash and Shloka's elder son Prithvi too accompanied his parents to the temple. Mukesh Ambani opted to keep it simple...

Election officials in Tamil Nadu's Nilgiris checked a helicopter carrying Rahul Gandhi while he was travelling to Wayanad.

Rouse Avenue court sends BRS leader K Kavitha to judicial custody till April 23 in excise policy case

Anmol Bishnoi, the brother of gangster Lawrence Bishnoi, is said to have accepted responsibility for shooting outside Salman Khan’s house...

A firing incident took place outside Salman Khan's home in Bandra today, and investigation is currently underway.

The BJP released its manifesto or Sankalp Patra, with tagline Modi ki Guarantee, for the Lok Sabha election 2024

Ahead of the Punjab Kings (PBKS) and Rajasthan Royals (RR) match at Mullanpur on Saturday, teammates Jos Buttler and Trent Boult...

The blast at the cafe occurred during lunch hour on March 1 at around 1 pm, which left 10 people...

APN News is today the most watched and the most credible and respected news channel in India. APN has been at the forefront of every single news revolution. The channel is being recognized for its in-depth, analytical reportage and hard hitting discussions on burning issues; without any bias or vested interests.

Priyanka Gandhi today addressed public rally in Ramnagar, Uttarakhand, where she asked BJP that for how long they will keep...

Anupam Kher took to his Instagram account to share a video on the birth anniversary of Satish Kaushik

Rishabh Pant-led team moved at 9th position after registering their win over LSG.

© Copyright 2022 APNLIVE.com