9 state elections held in 2023

Ranveer Singh's Deepfake AI video showing the actor promoting a political party, has gone viral ahead of the Lok Sabha...

A food vlogger shared a video clip on Instagram showing the meticulous preparation of blue-coloured ghee rice which has a...

Anurag Basu-helmed Metro In Dino, received a fresh release date after significant delays.

Do Aur Do Pyaar delves into modern relationship complexities via Kavya (Vidya Balan) and Anirudh (Pratik Gandhi). It tackles marriage...

Aditya Suhas Jambhale-helmed film Article 370, which released in theatres on February 23, has now debuted on Netflix

A video went viral amid the ongoing Phase 1 of the Lok Sabha Elections 2024, where a couple went to...

On the special occasion, his father-in-law and actor Suniel Shetty dropped a sweet birthday wish for KL Rahul. Suniel Shetty...

Vidya Balan who plays the lead role in Do Aur Do Pyaar looked ravishing in a navy blue lehenga which...

A 3-wicket haul early in the innings by Mukesh Kumar helped DC bowl out GT for 89 in 17.3 overs.

Soon after the news of Abhradeep Saha’s demise, social media users and fans started paying tribute to the viral sensation....

A video circulating on social media shows the luxury car Lamborghini Gallardo being burned and reduced to ashes. The police...

KKR lost to Royals by two wickets on Tuesday at Eden Gardens.

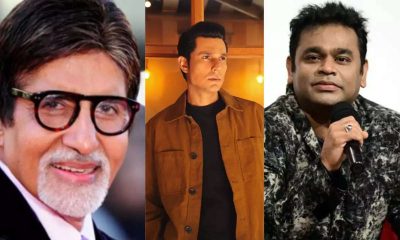

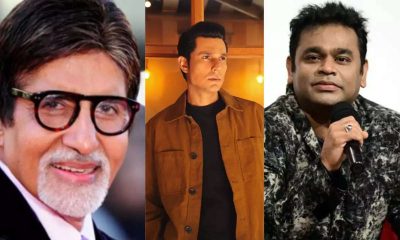

Amitabh Bachchan is set to be awarded the Lata Deenanath Mangeshkar Puraskar, while AR Rahman and Randeep Hooda will also...

Nath’s closest allies in his near 50-year reign—Deepak Saxena and Kamlesh Shah—have deserted him. His local team of corporators has...

Chennai recorded an average voter turnout of 34% as of 1 pm on Friday. According data released by the Election...

The Union Home Minister Amit Shah was accompanied by Gujarat CM Bhupendra Patel.

Annamalai expressed his confidence of a historic result for the NDA on June 4, the IPS officer-turned-politician said the BJP...

As the voting began, some of the BJP-TMC workers clashed in West Bengal's Cooch Behar constituency

Superstar Rajinikanth was accompanied by his publicist and his team at the polling both. He greeted everyone and flashed his...

Google released a doodle today, to mark the begining of Lok Sabha Elections 2024 in India.

Union Home Minister Amit Shah also urged citizens to vote in large numbers and added that it is not only...

The Enforcement Directorate (ED) made the claim before special judge for ED and CBI cases, Kaveri Baweja, who gave directions...

The Enforcement Directorate said in a statement that the Mumbai zonal office of ED has provisionally attached immovable and movable...

The Religious group broke glass windows and flower pots and pelted stones on the statue of St. Mother Teresa at...

BJP leader Suvendu Adhikari wrote a letter to the West Bengal Governor and sought a probe by the National Investigation...

The Election Commission advised the Bengal Governor to call off his proposed visit to Cooch Behar on April 19.

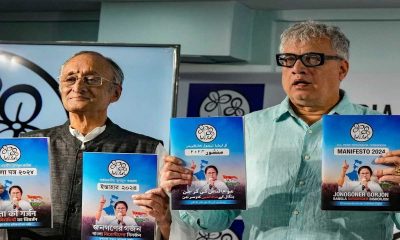

The Trinamool Congress has today released its manifesto for the Lok Sabha elections

Singer and TV personality Rahul Vaidya was recently stranded in the Dubai rains.

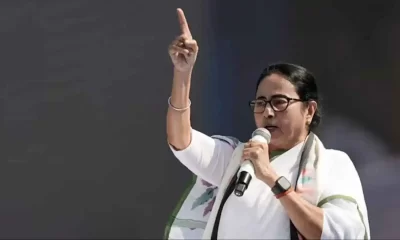

The Bengal chief minister added at an election rally that the BJP will win the election by vote looting and...

APN News is today the most watched and the most credible and respected news channel in India. APN has been at the forefront of every single news revolution. The channel is being recognized for its in-depth, analytical reportage and hard hitting discussions on burning issues; without any bias or vested interests.

Nima expressed her gratitude for the opportunity and her eagerness to contribute to the group's success.

The UAE witnessed record-breaking rainfall on Tuesday and the National Centre of Meteorology recorded 254 mm of rainfall in less...

Surya Tilak illuminated the forehead of Lord Ram Lalla idol at the Ram temple in Ayodhya on Ram Navami

© Copyright 2022 APNLIVE.com